Wattlestone’s long term investment in biogas platform, LGI listed on the ASX. “LGI has a strong pipeline of growth opportunities, investing capital to optimise the conversion of biogas to revenue, while maintaining its profitability and safety record,” chairman Vik Bansal who has also been recently appointed Managing Director of Kerry Stokes backed Boral group.

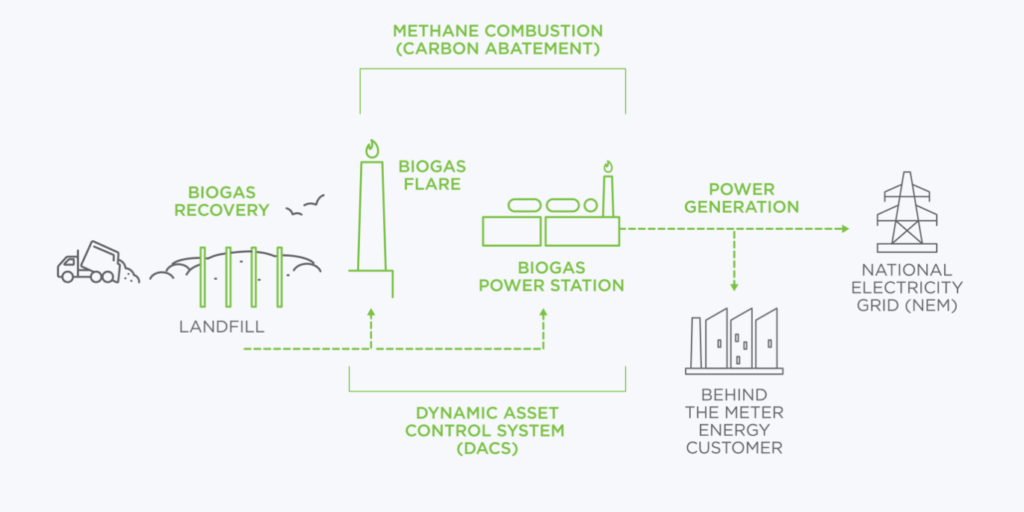

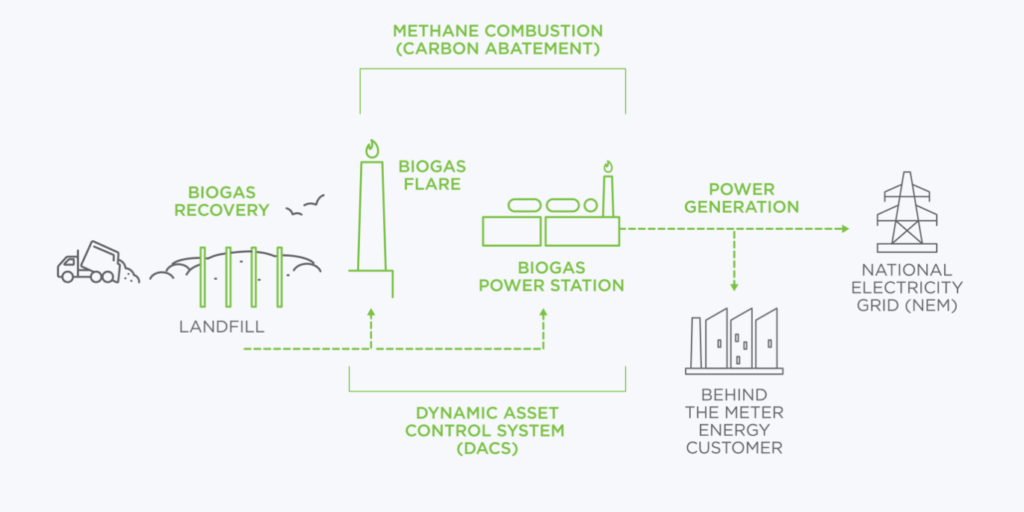

LGI which was established in 2009 and operates across 26 sites within Australia. LGI operations cover engineering and management of landfill gas infrastructure and creating solutions to generate renewable electricity and carbon abatement. We collaborate with landfill owners to solve the environmental problem of methane emissions, which are 28 times more potent than CO2.

Carbon abatement and carbon pricing are on the global agenda. Demand for carbon credits is expected to grow as organisations attempt to reach their 2030 and 2050 emissions targets by purchasing carbon credits and implementing their own carbon-neutral solutions.

There are more than 1,100 operational landfills in Australia alone. Of these, over 200 may be suitable (and another 100 that are yet to be assessed) for LGI solutions, creating an opportunity for organic growth. LGI generate distributed clean energy, with the ability to store and discharge renewable electricity at peak times to optimise pricing. LGI contracts with governments on average over 15 years to provide these solutions, producing recurring revenues and carbon credits.

The LGI story aligns with Wattlestone’s long term investment thematic which has seen Wattlestone make its first investments within the renewable space more than a decade ago. Wattlestone continues to look for opportunities to gain further exposure to the energy transition.